How Much Can I Borrow for Home Loan

We're reader-supported and may be paid when you visit links to partner sites. We don't compare all products in the market place, only we're working on it!

Lenders each take their own criteria for determining how much they will lend you lot. But when you're thinking nigh buying a belongings, yous also need to work out how much yous feel comfortable borrowing for a mortgage.

Interest rates may exist depression correct now, only they'll increase eventually – and when they do, you need to be sure you tin beget the repayments. That's why working out how much yous can borrow is most:

- Deciding how much you can beget today, and

- Being comfortable with a college repayment in the future

How banks decide what you can borrow

Lenders decide how much you lot can borrow based on what's known as serviceability calculations. These calculations accept into business relationship your income from various sources along with your expenses. Lenders then look at the proposed home loan debt as a proportion of your monthly income and build in a buffer for potential interest rate rises.

Lenders decide how much you lot can borrow based on what's known as serviceability calculations. These calculations accept into business relationship your income from various sources along with your expenses. Lenders then look at the proposed home loan debt as a proportion of your monthly income and build in a buffer for potential interest rate rises.

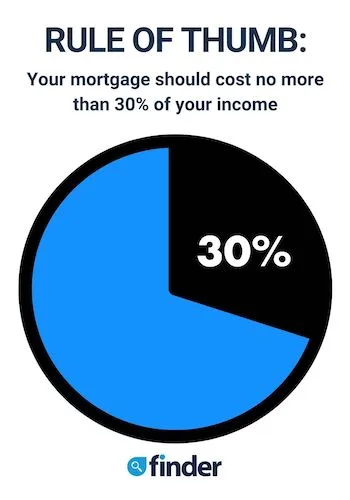

As a general guide, banks want to be sure than no more than than 30% of your income goes towards your home loan. For instance, if you earn $eighty,000 a year, that's $5,160 per month after revenue enhancement. You lot should spend a maximum of around $1,550 per month on your mortgage. Based on an interest rate of 2.5%, this would be a mortgage worth around $395,000.

When computing your expenses, lenders vary in their approach. While some look at your bodily expenditure, others utilize models that gauge your expenses. They do this by looking at the median Australian household spend for basics such as food, utilities and transport, and then adding in a set amount for discretionary spending.

How banks calculate your expenses

Based upon the lender's calculations of your monthly expenditure and your monthly income, lenders will decide the maximum amount of additional debt they believe you can service. In deciding on the size of the home loan to offer you lot, lenders will also take into account the type of property you're buying and the size of the eolith you take.

How y'all should decide what you tin borrow

What the bank will lend you may differ from the corporeality yous feel you can comfortably repay.

In some cases, a lender'due south estimate may exist on the low side, and y'all might be disappointed by the maximum corporeality available to you.

In other cases, a lender may be willing to extend yous more than credit than you feel comfortable accepting.

Before you lot make up one's mind how much you should borrow, you need to enquire yourself a few questions:

What kind of lifestyle practice you desire?

While home buying comes with many positive lifestyle changes, it tin besides mean some changes that tin exist hard to adjust to.

Taking on the responsibleness of a habitation loan could hateful you lot'll accept to curtail your spending in other areas, like eating at restaurants, spending on takeaways or online shopping. How significantly will depend on how much you borrow, as your mortgage repayment might exist higher than what yous pay in rent.

To get an idea of the amount a home loan volition add to your monthly budget, use the repayment calculator beneath. You can look at various borrowing scenarios to see what your repayments will be if you borrow different amounts.

Are y'all prepared to pay LMI?

Some lenders will approve a low deposit home loan with every bit fiddling as a 5% deposit, provided you lot're willing to pay lenders mortgage insurance (LMI).

LMI is an insurance policy that covers your lender if you default on your home loan. It'due south their chance protection policy, and information technology'south charged when you lot borrow more than 80% of the value of the holding yous're buying (ie with a deposit lower than 20%). LMI can add thousands of dollars to the cost of a home loan and will end upwards increasing your home loan repayments, if the premium is added to the loan. You can also cull the pay the premium upfront.

Avoid LMI and buy with just a 5% using the FHLDS

How disciplined are you?

Once yous've decided on the kind of lifestyle yous're comfortable with, yous'll take to assess whether yous have the field of study to stick to your new lifestyle.

You'll demand to take an honest look at your own fiscal discipline before you decide to accept on a home loan. It takes a fair amount of subject area to service any abode loan, merely a abode loan debt that substantially increases your monthly expenditures will require a very disciplined arroyo.

While information technology's important to work out a budget based upon the standard of living yous'd like to have, sticking to this budget will be the hard part. If you take a upkeep and find that you typically overspend, you demand to gene this into your cess when deciding how much to infringe. If financial field of study is difficult for you, exit yourself some elbowroom in your domicile loan repayments.

What life changes might be on the horizon?

Any life changes could impact your ability to repay your home loan. Although some life changes are unforeseeable, yous can factor others – like changing jobs, starting a family or moving cities – into your financial plan ahead of time.

Yous might not be able to predict all of the life changes that could happen during the term of your home loan, but it's wise to leave yourself some breathing room only in example.

What actress costs volition you need to pay?

The expense of a dwelling doesn't end with a home loan. Before you lot even move in, yous'll also demand to budget for other expenses involved in the dwelling buying procedure. You lot'll likely accept to pay stamp duty, legal fees and fees for building and pest inspections. Afterwards the home loan settlement, y'all'll also accept to pay for removalists to assistance y'all move into your new dwelling.

There are also ongoing expenses associated with home ownership. In addition to your home loan repayments, you'll take to cistron in habitation and contents insurance, council rates, utilities, maintenance and upkeep. If yous purchase an apartment or townhouse, you may also have strata or body corporate fees.

When deciding on how much you should borrow, proceed these ongoing expenses in listen forth with your home loan repayment.

Hidden costs of homeownership

Lenders are adequately conservative in their assessment of what you tin can afford. But every bit conservative as they might be, they can't factor in some of your unique personal circumstances. By taking the time to assess your own lifestyle and financial discipline, yous can make sure you don't have on more than than y'all can beget.

Compare today's home loan rates

Source: https://www.finder.com.au/how-much-should-you-borrow-for-your-home-loan

0 Response to "How Much Can I Borrow for Home Loan"

ارسال یک نظر